E-Waste Management

Summary Intelligence Report

Introduction

E-waste, comprising electrical and electronics products at the end of their life span with no potential for reuse, is a significant environmental concern. The global generation of e-waste has reached a staggering rate of 2 million metric tons per year and is projected to surpass 74 million metric tons by 2030.1 Factors such as increased consumption of electrical and electronic equipment, shorter product lifespans, and obsolescence have contributed to a twofold increase in e-waste over approximately 16 years.

Discarded e-waste poses both an environmental challenge and an opportunity to reclaim valuable materials. For instance, a discarded modern smartphone may contain over 70 stable metals out of the 83 elements in the periodic table2 and the heat exchange equipment with residual refrigerants could harbor greenhouse gases (GHG) that contribute to global warming if not responsibly managed.

The most viable solution to address this issue is e-waste recycling. Recycling allows the reintegration of end-of-life e-waste and its components into the economic cycle, fostering resource conservation, reducing GHG emissions, and creating job opportunities. Globally, various legislations and directives advocate for the recycling and proper disposal of e-waste.

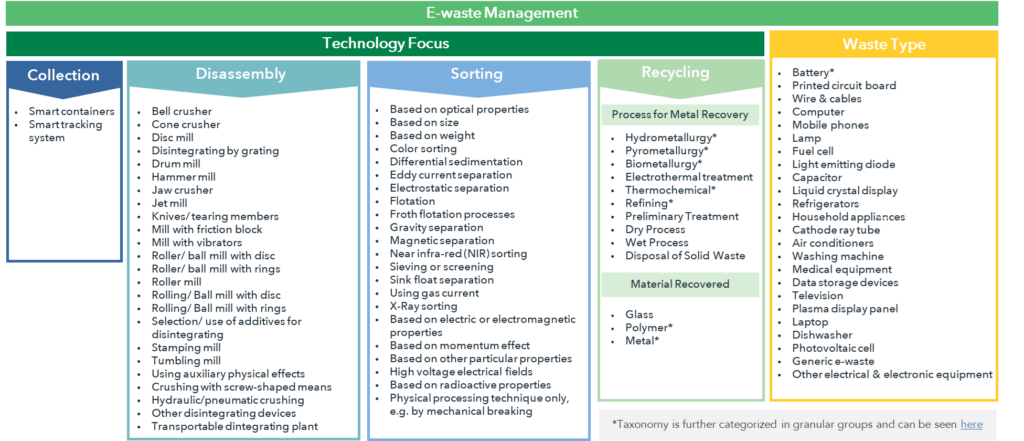

This report from IAC on E-waste Management delves into trends in this domain, categorizing patent publications based on technologies employed in e-waste management, including collection, dismantling, sorting, and recycling. The study’s taxonomy is applied to analyze patent filings related to these techniques as well as waste types, revealing trends and identifying gaps. The report further explores value chains for recycling battery waste.

A comprehensive total of 17,151 patent families filed since 2010, focusing on e-waste technologies, were uncovered in the study. Some patent filings, categorized under recycling, may also address disassembly, sorting, or collection technologies. Various techniques, such as hydrometallurgy, pyrometallurgy, thermochemical and bio-metallurgy, alongside metal refining processes, are utilized for e-waste recycling to recover metals, polymers, and glasses. Notably, around 85% of patent families concentrate on the recovery of metals.

The report also highlights key companies, and their patent filing trends, extracting valuable insights from the market research available over the last five years and considering the patent litigation standpoint. Figure 1.1 in the illustration depicts the technology taxonomy for the study, and the resulting dataset is tagged based on Technology Focus and Waste Type, derived from patents filed since 2010. For a more detailed perspective, IAC’s full report offers granular insights into patent filings categorized in various technologies used in e-waste management.

Key Takeaways

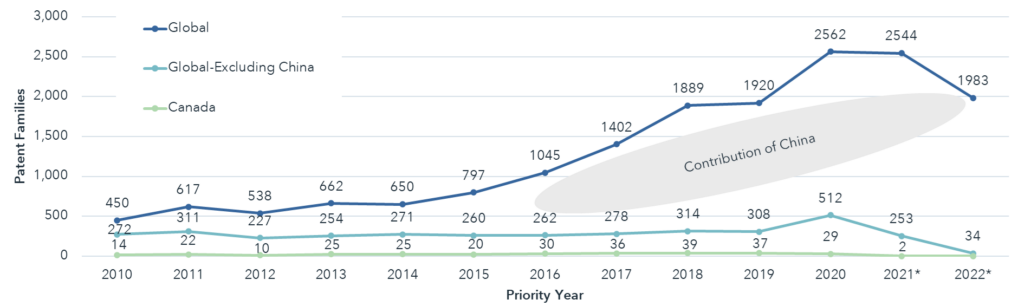

Geographic Filing Trends

In the realm of e-waste recycling trends, patenting activities in the Asia-Pacific region, particularly in China, the Republic of Korea, and Japan, have exhibited dominance. China stands out with the highest number of patents, totaling 17,264, including 4,993 utility patents. The surge in patent filings in China began in 2014, driven by strategic regulations governing e-waste and subsidized funds for Waste Electrical and Electronic Equipment (WEEE) recycling. Notably, this momentum is sustained by proactive states in China, boasting a sizable number of commercially active companies that adhere to an “Extended Producer Liability” policy for electronic products.3 Academic institutions in China also play a substantial role in contributing to patent filings. In contrast, patent filing activities from countries outside China have experienced a period of stagnation over the last decade.

The evolution of the patent filing trend can be delineated into two distinct phases:

(a) Phase 1, spanning from 2010 to 2014, witnesses a stagnant phase in patent filing activities.

(b) Phase 2, commencing from 2014 onward, reveals a linear growth rate in patent filing activities related to e-waste management. This growth is propelled by increased demand for Electric Vehicles (EVs), technological advancements, regulatory measures addressing e-waste recycling, and the influence of the Basel Convention, which aims to regulate the transboundary movement of e-waste.

Technology and Industry Trends

The surge in Electric Vehicle (EV) sales by 55% since 2021 has amplified the focus on battery waste, posing a potential challenge if not adequately disposed of or recycled. A closer examination of the report reveals that the majority of patent filings center around the recycling of waste batteries, closely followed by printed circuit boards and wire & cables.

In the realm of recycling technologies, advancements draw inspiration from metal recovery techniques employed in the mining industry. These technologies encompass hydrometallurgy, pyrometallurgy, thermochemical and bio-metallurgy, as well as various metal refining processes. Hydrometallurgy takes precedence over pyrometallurgy due to its lower energy requirements, the ability to recover materials in both high quality and quantity, and a more economical capital cost.

Among the Hydrometallurgy technologies, acid leaching stands out with the highest number of innovations, showcasing an upward trend in patent activity over the past decade. Acid, functioning as a leaching agent, proves effective in extracting both base and precious metals. Various acid leaching agents, such as nitric acid, sulfuric acid, hydrochloric acid, and others, contribute to this process.

Over the last five years, a noteworthy influx of patent families has emerged in the domain of thiosulfate leaching. Thiosulfate, recognized for its non-corrosive nature, reduced toxicity, slow kinetics, and pH sensitivity, has become a focal point in recycling innovation. This shift in emphasis reflects the industry’s commitment to exploring environmentally friendly and efficient alternatives in the pursuit of sustainable e-waste recycling solutions.

Key Players

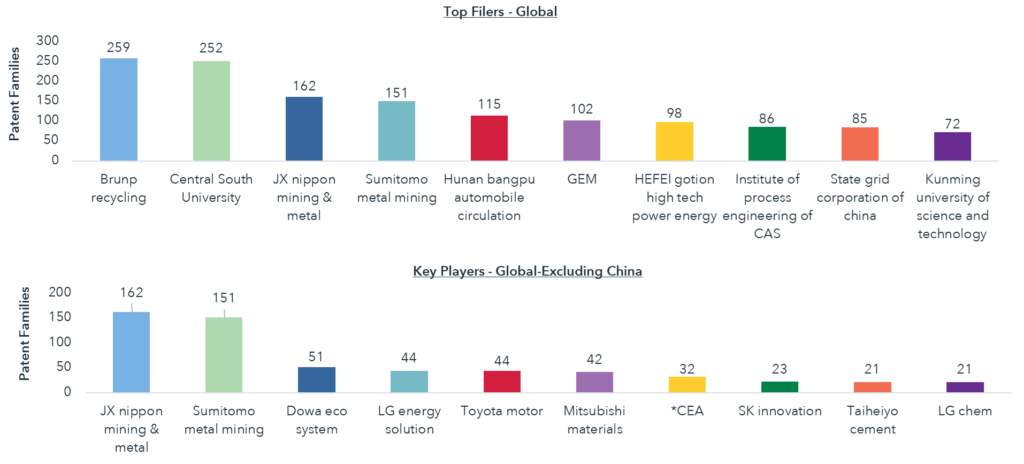

In the roster of leading battery recyclers, Asian and European entities prominently occupy the top positions:

- China: Huayou Cobalt, Brunp, Ganfeng Lithium, GEM, Ganzhou Highpower

- Japan: JX Nippon Metal & Mining, Dowa Eco

- Europe: Accurec, Umicore

On the patenting front, we see that Brunp Recycling, Central University, and other Chinese academia contributing majorly to the total tally of top filings in the e-waste space in the world. When we exclude Chinese patent filers, we see JX Nippon, Sumitomo Dowa, LG, and Toyota as global players that have patent filings spread across geographies.

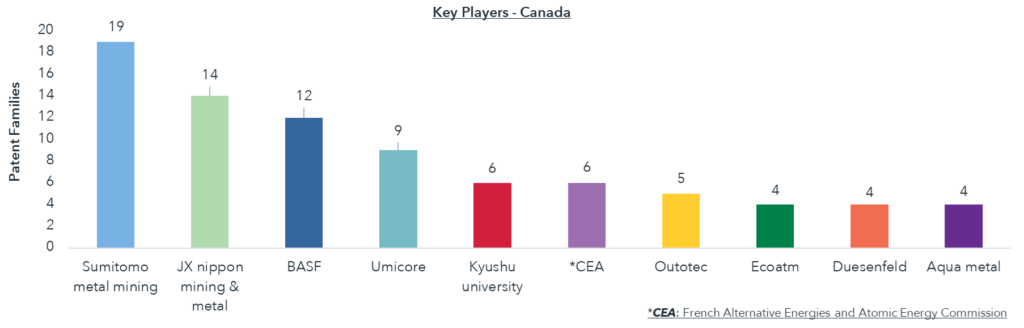

*CEA: French Alternative Energies and Atomic Energy Commission

Canadian landscape

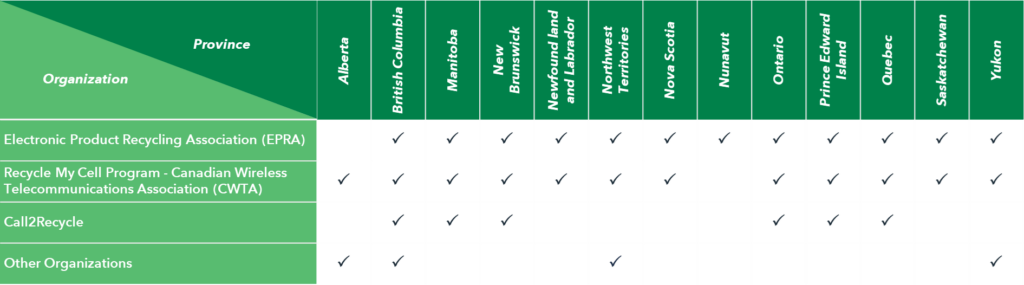

The most recent e-waste data available for Canada dates to 2019, as assessed by the United Nations University, highlighting the pressing need for an update in Canada’s e-waste data.4 In 2019, the per capita generation of e-waste was estimated at 20.9 kg, totalling 757 kt, with an e-waste collection rate of less than 20%.5

E-waste collection initiatives in Canada are predominantly steered by government-funded programs such as EPRA, Recycle My Cell, and Call2Recycle, operating across various provinces. Notably, these programs play a pivotal role in enhancing e-waste collection rates.

International entities significantly shape Canadian patent filings in the field, with prominent contributors including Umicore, a Belgian materials technology and recycling group; American companies EcoATM and Aqua Metal; Finnish firm Outotec; and Kyushu, a Japanese university.

On the global stage, JX Nippon Metal & Mining, Sumitomo Metal Mining, and BASF stand out as dominant forces in e-waste management, and their influence extends to Canada. JX Nippon Metal & Mining’s impact on the Canadian market is exemplified by its acquisition of eCycle Solution, an Ontario-based recycling company, further solidifying their presence in the country.

Montreal-based Lithion, a key player in lithium-ion battery recycling solutions, is leaving a notable imprint through strategic partnerships and investments within and beyond Canada. For instance, Lithion Recycling has exclusively licensed its lithium-ion battery recycling technology to IS Dongseo Company in South Korea. Lithion has also collaborated with Girardin Bus for the recycling of electric school buses, and a strategic partnership with GM is underway to establish a circular EV battery ecosystem. Other prominent contributors shaping the Canadian e-waste technology landscape include Li-cycle, Call2Recycle, RecycLiCo, Cirba, and Gold Lion Resource. Together, these entities are pivotal in driving innovation and sustainability in the management of electronic waste in Canada.

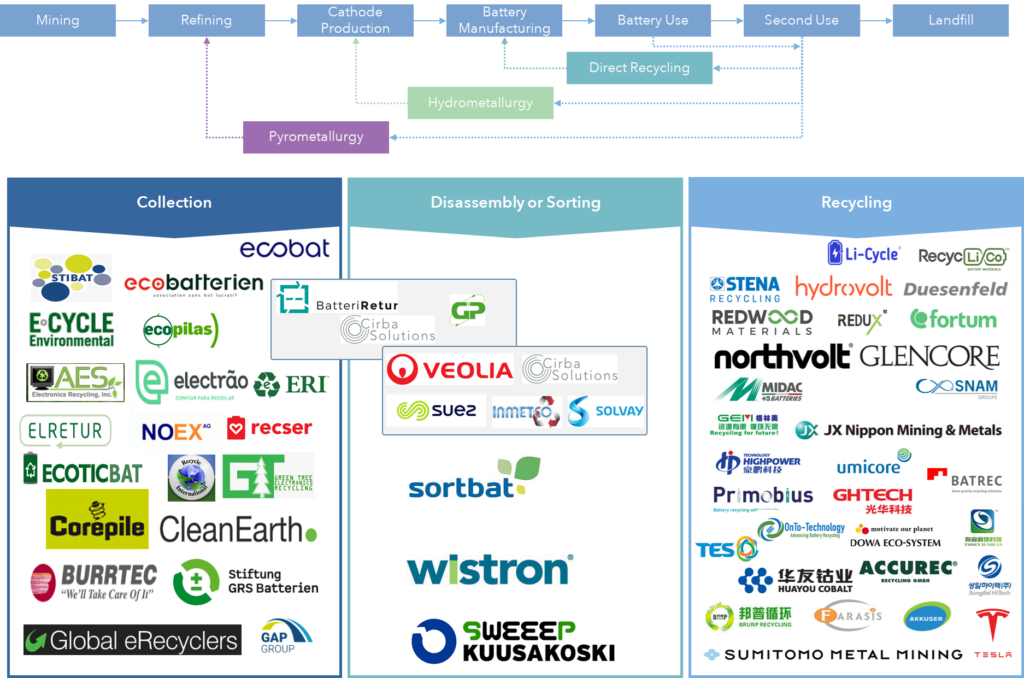

Value Chain

The comprehensive E-waste management report provides a detailed depiction of the value chain associated with the primary contributor to e-waste, which is batteries. In Figure 1.6, the battery recycling value chain is elucidated, spanning from mining through landfills. This figure offers a comprehensive overview of the battery lifecycle and the intricacies of the recycling process.

Scope, Methodology & Assumptions

This summary report provides a glimpse into IAC’s comprehensive landscape report on E-waste management. The study exclusively focuses on E-waste management and recycling, aiming to uncover essential technologies, key players, and prevailing trends in the field. To categorize patents associated with E-waste management across diverse technological segments, a semi-automated patent analysis approach was employed. The search for patent filings utilized Questel Orbit, and bibliographic details were extracted from IFI Claims. Notably, a detailed analysis was conducted on a representative member selected from the identified patents.

IAC’s detailed IP Intelligence Reports are available exclusively to our members. To access the full E-Waste Management report and other valuable resources, click the button below to explore the advantages of an IAC membership.

References

1 Source: GEM 2020 – E-Waste Monitor (ewastemonitor.info)

2 Source: FutEWSc.pdf (unep.org)

3 Source: The Regulatory Environment for Lithium-Ion Battery Recycling (acs.org)

4 Source: GEM_2020_def.pdf (itu.int)

5 Source: Canada – 2015 – E-waste statistics (globalewaste.org)

Disclaimer: The content of this document may have been derived from information from third-party databases, the accuracy of which cannot be guaranteed. IAC hereby disclaims all warranties, expressed or implied, including warranties of accuracy, completeness, correctness, adequacy, merchantability and\or fitness of this document. Nothing in this document shall constitute technical, financial, professional, or legal advice or any other type of advice, or be relied upon as such. Under no circumstances shall IAC be liable for any direct, indirect, incidental, special, or consequential damages that result from use of or the inability to use this document.

© 2023 Innovation Asset Collective. All rights reserved.