Wireless Power Transfer

Summary Intelligence Report

Introduction

Wired power transfer that we encounter in our everyday lives provides enough power but restricts mobility and has safety issues. Wireless power transfer is a powerful new technology that uses fields created by charged particles to carry energy between a transmitter and a receiver over an air gap and is therefore a great substitute for wiring on many electrical devices. The global wireless power transmission market was valued at USD 35.13 billion in 2021 and is expected to reach USD 170.19 billion by 2029, registering a CAGR of 21.80% during the forecast period of 2022-2029.1 Near-field technologies account for the largest segment in the wireless transfer market due to their widespread application across various industries. Specifically, the magnetic resonance technology used in wireless charging stands out as one of the fastest-growing segments within this market. The wireless charging technology sector is a competitive space, which makes it prone to patent litigation. Notably, some key players like Samsung and Apple have faced threats from NPEs (Non-Practicing Entities) as well.

The world over, there is an evident push towards adopting wireless power transfer technologies. For instance, the U.S. Navy is developing an underwater charging station for its unmanned undersea vehicles. The technology, which does away with cables, will make it easier for drones to recharge at sea.2 As a result, in future, lots of Navy drones will be able to power up this way. Germany is also going to host a first public trial of “wireless charging” in a kilometre-long strip in the German town of Balingen, in an attempt to address “range anxiety” while driving electric vehicles.3 The Canadian government is also supporting the wireless power transfer ecosystem by supporting companies such as Solace towards increasing the capacity of WPT solutions to benefit various sectors and offering rebates for the installation of wireless charging stations at offices and homes.4

IAC’s report on Wireless Power Transfer explores various trends in the near-field wireless power transfer domain including inductive coupling, magnetic resonance, capacitive coupling and capacitive resonance. The study also identifies various key companies along with their patent filing trends while capturing useful insights from the market, standards, standard essential patents and patent litigation standpoint.

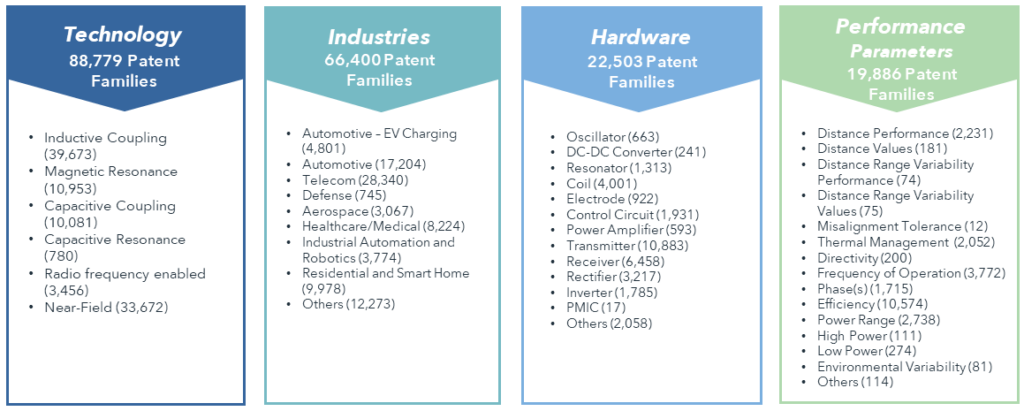

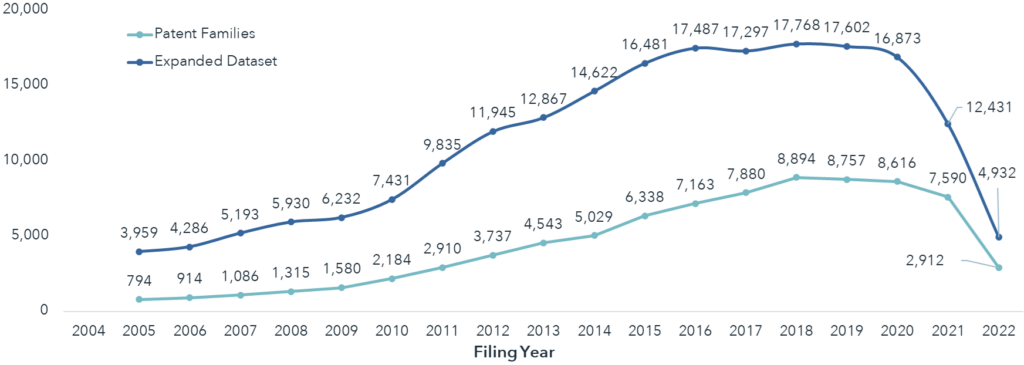

Patent publications were categorized with respect to the various technologies used in WPT, industries where WPT technologies are applicable, hardware components used in WPT and performance parameters for WPT and are classified in accordance with the study’s taxonomy, and then analyzed to understand trends and gaps. This study also explores and provides details about the value chains for electric component suppliers, design and engineering solutions providers, sales & distribution, and manufacturing of WPT products. 88,779 patent families (see Fig. 1.1) were analyzed for this report. One member per INPADOC patent family was considered for analysis. The reduced patent dataset includes the patent member that is the most recent publication. Data on the market and standards was taken from available publications, articles, and literature.

Wireless Power Transfer – 88,779 Patent Families

Note: For patent or applications, if multiple categorizations were possible, we have bucketed them in multiple categories.

Radiative techniques (far-field), in which power is transmitted by means of electromagnetic waves or laser beams have been excluded from analysis for the scope of this study.

Key Takeaways

Geographic Filing Trends

The US has the strongest IP and market presence in the WPT sector with 58,324 patent filings and an estimated market share of US$ 1.7 billion in 2020. Consequently, patent litigations in the wireless charging technology space are also the most in the US. China has the second largest number of patent filings, however, about 36% of its total patent applications are utility models. Japan, Europe and South Korea are also among the topmost preferred jurisdictions with 19,538, 17,959 and 14,468 patents/published applications, respectively. Canada is at the 5th spot in most patent filings, with a market estimated to grow at 20.4% from 2020-2027.

IAC’s full report gives a more granular view of patenting activity globally with and without China.

Technology and Industry Trends

A lot of products we interact with on a daily basis are based on inductive coupling technology. For example, the charging technology we find in most rechargeable electric toothbrushes is based on inductive coupling. It is not surprising that the highest number of patents amongst key technologies considered for this study focus on inductive coupling, accounting for almost 43% of the total assets. In contrast, capacitive resonance has the fewest patents among all the key technology areas considered for this study. There are also very few companies operating in this area. This could present opportunities for innovating and protecting IP for companies operating in the WPT space.

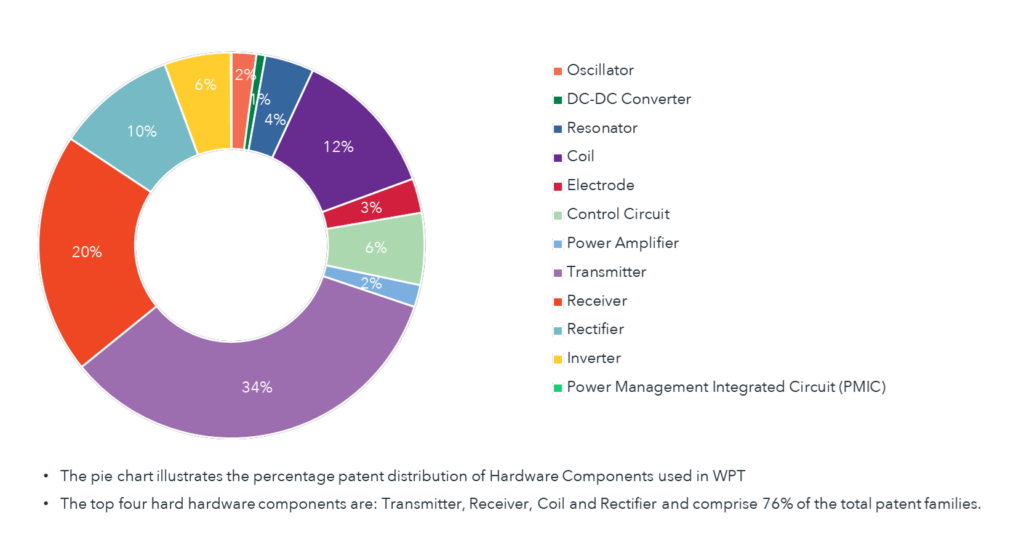

Automotive and Telecom are two of the application sectors with a significant number of patent filings and a sizeable market. On the other hand, transmitter, receiver, coil and rectifier are the top four hard hardware components comprising 76% of the total patent families in the hardware category. With wireless charging gaining ground, especially in smartphone and electric vehicle applications, it may be crucial to protect standard as well as disruptive technologies in this space at the soonest. The pie chart distribution in Fig. 1.3 shows a distribution of patent filings in the WPT space, specific to hardware components such as oscillators, transmitters, receivers, coils and rectifiers.

Patent litigations and some key players in the WPT arena

The last few years have seen a rise in patent litigations in the Wireless Charging Technology field with Scramoge (NPE) being one of the key Plaintiffs. Scramoge has sued key players in this technology space, such as Samsung, Apple, and Google. Creekview IP, Mojo Mobility and WiTricity (an MIT spin-off) are new plaintiffs in the Wireless Charging space. For instance, WiTricity sued the Pennsylvania-based clean tech start-up Momentum Dynamics Corporation for infringing several of its patents involving technology on the wireless charging of electric vehicles. Start-ups in this space need to be wary of such litigations.

Key Players

Samsung and State Grid Corp of China are the top filers in the wireless power transfer space. LG, Panasonic, Qualcomm, Toyota, BBK, Apple, and Philips are some of the key filers in the WPT space. It was found in the study that Qualcomm’s patent filings started dwindling from 2017 onwards, owing in part to the sale of its Halo wireless electric vehicle charging technology to MIT spinoff WiTriCity.

| Technology Taxonomy | Key Players |

|---|---|

| Inductive Coupling | State Grid, Panasonic, Philips, Bosch, Samsung |

| Magnetic Resonance | Samsung, LG, Toyota, Qualcomm, State Grid |

| Capacitive Coupling | State grid, Samsung, Qualcomm, Panasonic, Murata, Toyota |

| Capacitive Resonance | Mitsubishi Corporation, Fujitsu, Samsung, Philips, South China University of Technology |

| WPT Hardware | LG, Samsung, Panasonic, Qualcomm, WiTriCity, Toyota, State Grid |

| WPT Industries | Samsung, State Grid, LG, Panasonic, Qualcomm |

Canadian landscape

There are about 2,946 patent families (4,973 total patent assets), related to Wireless Power Transfer technologies in Canada. There have been consistent filings over the last decade in Canada, however, Canadian patent filings form only about 2% of the total patent filings in the world. Alstom, Johnson & Johnson, Blackberry, Medtronic, Alticor and Boston Scientific are some of the top filers in Canada. Alstom, having maximum Canadian patents in this domain, is a French multinational company operating in the transportation sector, however, leads in the number of patents in Canada that focus on Transmitters. When we look at the Canadian players active in patent filing in the WPT space, Blackberry and Solace feature among the top filers. A Mount Pearl, Canada-based company, Solace Power features as a top filer with a stronghold in various technologies in the WPT space. Solace is especially dominant in Magnetic Resonance, and Capacitive Resonance with many of their patent families extending to US, Hong Kong, Singapore, India and Korea. Blackberry has 80 patent families with more than 60 patent filings spread across Europe, US, China, Hong Kong and Korea.

The telecom industry remains the prime consumer/innovator in the WPT space with Blackberry, Qualcomm, Emerson Electric to name a few, spearheading patent protection in Canada. Patenting activity in the Healthcare/Medical space related to WPT has also seen a proliferation in the last couple of years.

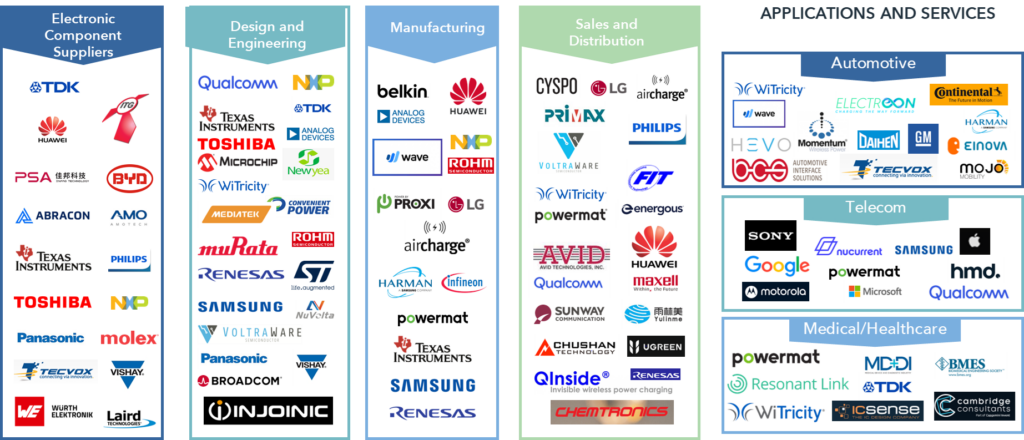

Value Chain

Figure 1.4 shows the global value chain for Wireless power transfer. The value chain comprises of key players across the WPT value chain. The value chain involves electronic component manufacturers, design and engineering of WPT systems and solutions, manufacturing, sales and distribution and application and services industries such as telecom, automotive and healthcare. Solace, Elix, Moblek, Power2Go, eLeapPower, UTEV (University of Toronto Electric Vehicle), Flo, Green Power, BEQ Technology, MED-EL, and Blackberry are some Canadian players active across the WPT value chain. The full report illustrates key players in the global as well as Canadian value chain.

Scope, Methodology & Assumptions

This summary report gives an overview of IAC’s detailed landscape report on Wireless Power Transfer. WPT can be categorized into near field and far field. The scope of this study is limited to near-field WPT, further categorized into inductive coupling (inductive WPT and magnetic resonance) and capacitive coupling (capacitive WPT and capacitive resonance).

Granted patents or patent applications have been included in multiple categories wherever applicable and possible. For example, a patent claim reciting inductively coupled charging and magnetic resonance charging for an electric vehicle is marked in categories – Inductive Coupling and Magnetic Resonance (i.e., technology nodes) and in Automotive – EV charging (Industry). This shows the overlap between different taxonomy nodes (i.e., Technology and Industry in this example).

IAC’s detailed IP Intelligence Reports are available exclusively to our members. To access the full Precision Agriculture report and other valuable resources, click the button below to explore the advantages of an IAC membership.

References

3 Source: Wireless charging offers hope for mass electric vehicle use | Financial Times (ft.com)

Disclaimer: The content of this document may have been derived from information from third-party databases, the accuracy of which cannot be guaranteed. IAC hereby disclaims all warranties, expressed or implied, including warranties of accuracy, completeness, correctness, adequacy, merchantability and\or fitness of this document. Nothing in this document shall constitute technical, financial, professional, or legal advice or any other type of advice, or be relied upon as such. Under no circumstances shall IAC be liable for any direct, indirect, incidental, special, or consequential damages that result from use of or the inability to use this document.

© 2023 Innovation Asset Collective. All rights reserved.