Clean Hydrogen Production

Summary Intelligence Report

Introduction

Global hydrogen usage in 2022 rose by about 3% compared to the previous year, except for Europe, which experienced a decline due to increased natural gas prices impacting industrial activity. Hydrogen, as the simplest and most abundant element, is a great candidate for energy storage and transportation. However, its predominant production from fossil fuels contributes to CO2 emissions, prompting a push for cleaner alternatives to combat climate change. Investments and innovations in hydrogen production focus on reducing carbon emissions, with clean hydrogen emerging as a key player in achieving net-zero emissions by 2050, particularly in “hard-to-abate” sectors like heavy industry and transport.

In the past decade, clean hydrogen technology has advanced significantly, with projections indicating potential annual production of 38 Mt of low-emission hydrogen by 2030, pending project realization, despite numerous projects being in early stages. As more nations unveil national strategies and policies to support early adopters in the low-emission hydrogen sector, the slow implementation of these policies and the lack of measures to boost demand are hindering the sector’s expansion1.

IAC’s report reflects on these challenges, innovations and developments

In IAC’s study, clean hydrogen is defined as hydrogen derived from renewable energy sources or decarbonized non-renewable sources, without relying on color-coded terminology due to evolving production technologies.

IAC’s Clean Hydrogen Production report delves into the dynamic competitive landscape of the clean hydrogen ecosystem, analyzing the progression of innovation and commercial activities across various segments.

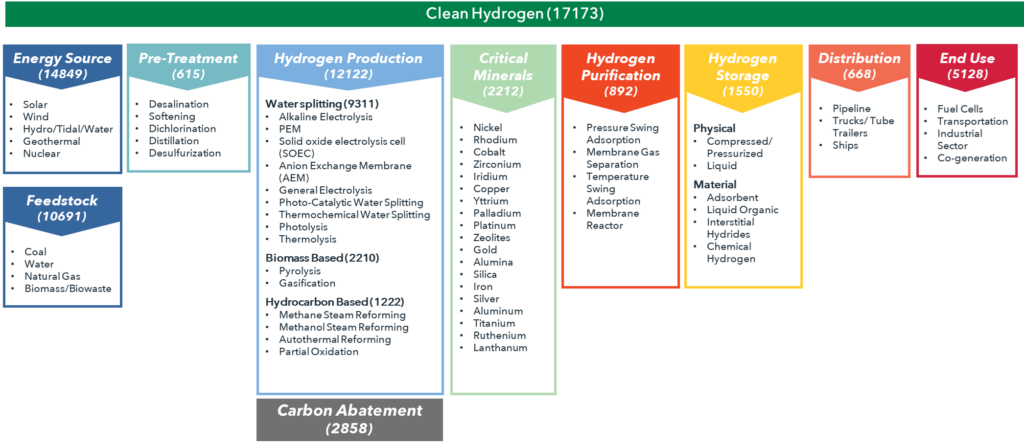

17,173 patent families were analyzed for this report. These patents were categorized into various technologies using a technology taxonomy as seen below.

Fig. 1.1 Technology Taxonomy for Clean Hydrogen

Key Takeaways

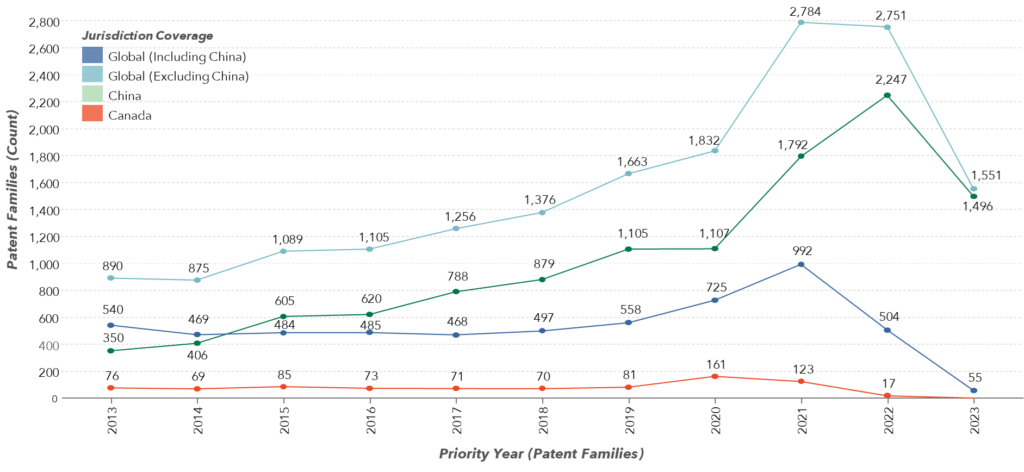

Geographic Filing Trends

In the clean hydrogen sector, China appears to stand out with the highest number of patent families, totaling 11,395. Most of the patent filings are by universities & research institutes followed by state-owned corporations. Since 2014, China has demonstrated a notable acceleration in patent filings and a sharp increase can be seen in 2020.

After excluding China, USA leads the patent filings followed by Japan and South Korea.

Technology and Industry Trends

Solar and wind energy serve as primary sources for the electrolysis process in green hydrogen production. Water stands out as the predominant feedstock for hydrogen production, utilized in electrolysis or water splitting processes. Notably, electrolysis stands out as the category with the highest number of patent families (9,311) in the study.

Although photocatalytic water splitting exhibits potential in academic research and patent filings, Anion Exchange Membrane (AEM) and Proton Exchange Membrane (PEM) electrolysis methods currently dominate the market. This is attributed to their superior efficiency, scalability, and cost-effectiveness compared to photocatalytic techniques.

Key Players

The Clean Hydrogen landscape, excluding Chinese applicants, is led by players in chemical, energy & gas, automobile, and hi-tech sectors. Major players in chemical industries such as China Petroleum, Sabic, Topsoe, and Air Liquide have significant filings in PEM & Alkaline electrolysis and photocatalytic water splitting methods. Technology and hi-tech players like Toshiba, Panasonic, and Hitachi are key filers in SOEC & PEM electrolysis methods.

Original Equipment Manufacturers (OEMs) like Honda, Toyota, and Hyundai are claiming fuel production systems using water electrolysis with clean hydrogen as fuel to power motive engines.

Value Chain

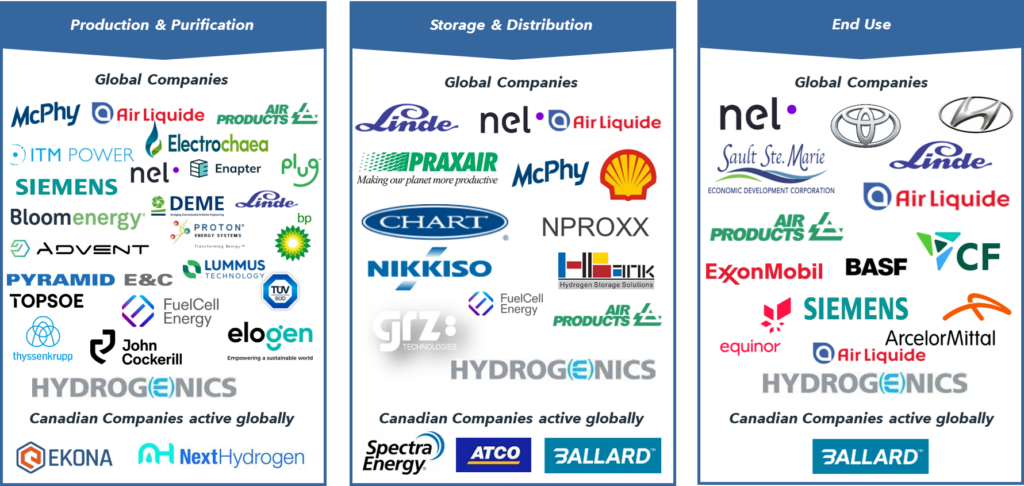

IAC’s landscape report provides a detailed depiction of the value chain associated with the key players involved in various stages of clean hydrogen life cycle such as: Energy, Feedstock, Components & Equipment; Production, Purification & Decarbonization; Storage & Distribution, and End Use.

Figure 1.3 shows companies active globally in Production & Purification, Storage & Distribution and End Use. Value chains for players active in Canada & globally and across other domains of clean hydrogen such as Energy, Feedstock, and Components and Equipment are presented in the full report.

Fig. 1.3 Worldwide value chain – key players active in Production, Storage & Distribution, End Use

Canada: Clean Hydrogen Innovation Hub with Strongholds by Foreign Entities

Canada has the opportunity to lead the global clean hydrogen sector with its vast natural resources, ambitious government strategies, diverse stakeholders, and innovative companies. Canada’s Hydrogen Strategy, launched in 2020, aims for net-zero emissions by 2050. Provinces like Alberta, Saskatchewan, and Quebec have introduced complementary initiatives to accelerate hydrogen development. Various government agencies provide funding, infrastructure support, and regulatory frameworks for a sustainable hydrogen industry. Startups and SMEs like Proton Technologies, Next Hydrogen, Iogen, and Ekona are developing and commercializing innovative clean hydrogen technologies.

Key Players

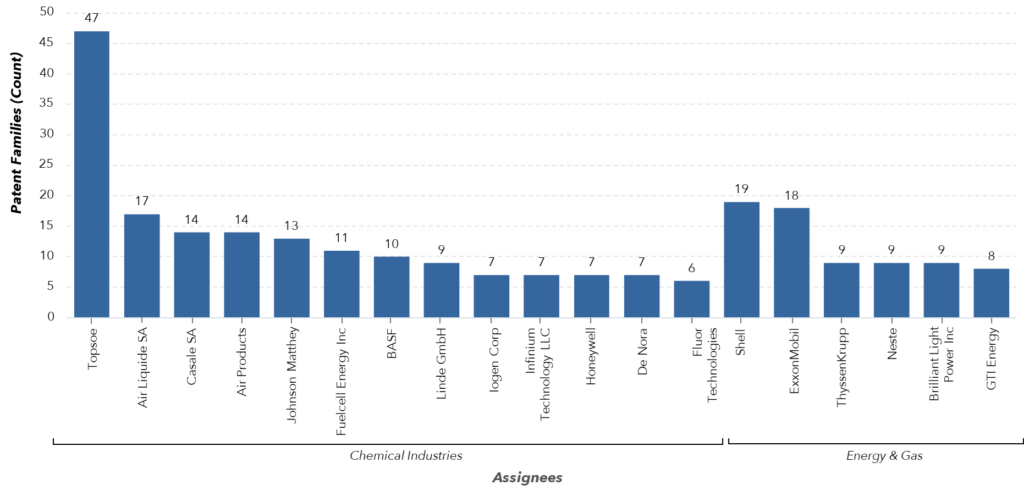

Canadian hydrogen production methods-related filings have steadily increased over the past decade, with a surge of innovation observed in 2020. Players from the chemical and CCUS industry such as Topsoe, Air Liquide, Air Products, and Johnson Matthey hold key patent filings in Canada.

Energy & Gas giants Shell and Exxonmobil are also focused on exploring clean hydrogen production methods in the Canadian ecosystem, supported by government funding and adaptive policies. Notably, all these companies are foreign entities to Canada with considerable patent filings and have a stronghold in the Canadian market. SMEs must have strategies to navigate the risks posed from the strong IP positions of such players. Some of these strategies may include conducting a patentability search prior to filing a patent application, IP Insurance and a freedom-to-operate (FTO) analysis prior to entering a market. IAC grants funds to its members for such studies as well as offering IP Insurance to its full members. IAC grants

Fig. 1.4 Top patent filers in Canada

Hydrogen Hubs

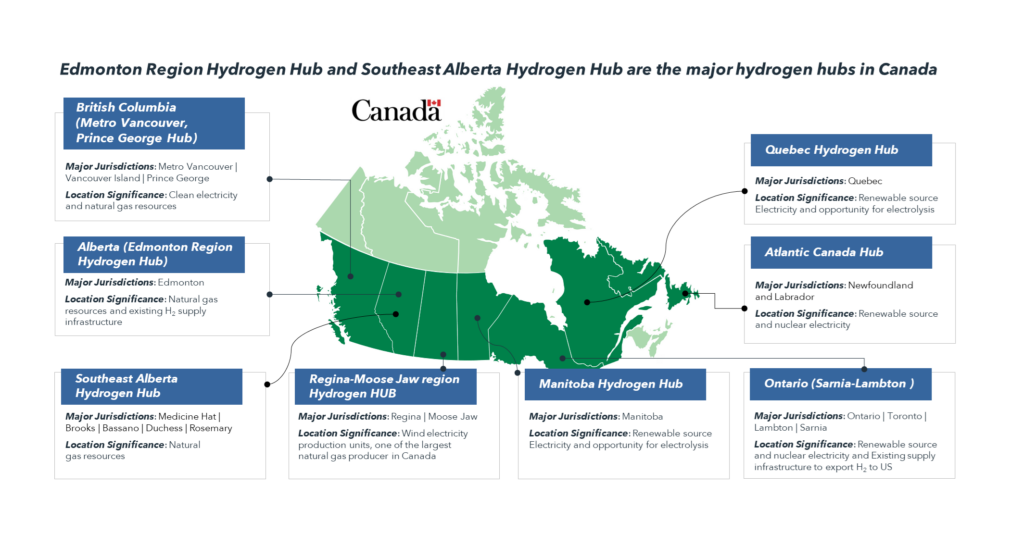

A hydrogen hub is a network or cluster of interconnected elements involved in the production, transportation, and use of clean hydrogen, all located near each other. Several countries have hydrogen hubs including Canada. Edmonton Region Hydrogen Hub and Southeast Alberta Hydrogen Hub are the major hydrogen hubs in Canada.

How can SMEs leverage IP to capitalize on Hydrogen Hubs?

IP Licensing: Canadian SMEs can use their IP to foster strategic partnerships and collaborations, including entering into licensing agreements which can eventually create additional revenue streams to support other activities.

Expanding Markets through Strategic IP Development: When devising their IP strategies, companies should consider the market and IP positions of entities within their value chains and strategically develop IP to help expand market reach and adoption.

Attract investment: By showcasing the value proposition of their patented technologies, startups can attract potential investors, partners, or customers interested in deploying innovative clean hydrogen solutions.

IAC’s full report on Clean Hydrogen delves deeper into Hydrogen hubs in Canada and the opportunities presented by these hubs for Canadian SMEs.

Fig. 1.5 Hydrogen Hubs in Canada

IAC’s detailed IP Intelligence Reports are available exclusively to our members. To access the full Clean Hydrogen Production report and other valuable resources, click the button below to explore the advantages of an IAC membership.

References

1 Source: Hydrogen – IEA

Disclaimer: The content of this document may have been derived from information from third-party databases, the accuracy of which cannot be guaranteed. IAC hereby disclaims all warranties, expressed or implied, including warranties of accuracy, completeness, correctness, adequacy, merchantability and/or fitness of this document. Nothing in this document shall constitute technical, financial, professional, or legal advice or any other type of advice, or be relied upon as such. Under no circumstances shall IAC be liable for any direct, indirect, incidental, special, or consequential damages that result from use of or the inability to use this document.

© 2024 Innovation Asset Collective. All rights reserved.