Carbon Management

Jun 2025 | 15 mins read

Jun 2025 | 15 mins read

As the world accelerates toward net-zero emissions by 2050, carbon management has become a critical component of credible climate strategies. While clean energy and electrification have made significant progress, they cannot eliminate emissions from all sectors. Heavy industries such as cement, steel, aviation, and fossil-fuel-based hydrogen remain particularly difficult to decarbonize.

Carbon management technologies, especially carbon capture, utilization, and storage (CCUS), offer viable solutions for these hard-to-abate emissions. According to the International Energy Agency, CCUS capacity must grow more than 120-fold by 2050 to capture at least 4.2 gigatons of CO₂ annually. This scale underscores the essential role of carbon management in meeting global climate targets. (Source)

In recent years, climate ambition has intensified, with many countries legislating emissions goals and accelerating the adoption of low-carbon technologies. Yet carbon management has lagged behind in cost reductions and deployment. Without it, 15 – 20% of global emissions will remain unaddressed.

Today, carbon management is no longer a supplementary measure – it is being treated as strategic infrastructure. Policies, investment, and innovation are converging to drive this shift. For businesses and governments alike, integrating carbon management is essential not just for compliance, but for long-term resilience, competitiveness, and environmental credibility.

IAC’s Carbon Management IP Intelligence Report explores this evolving ecosystem, offering a deep dive into the competitive landscape and innovation trends across Carbon Capture, Utilization and Storage (CCUS), Transportation, and Enabling Technologies.

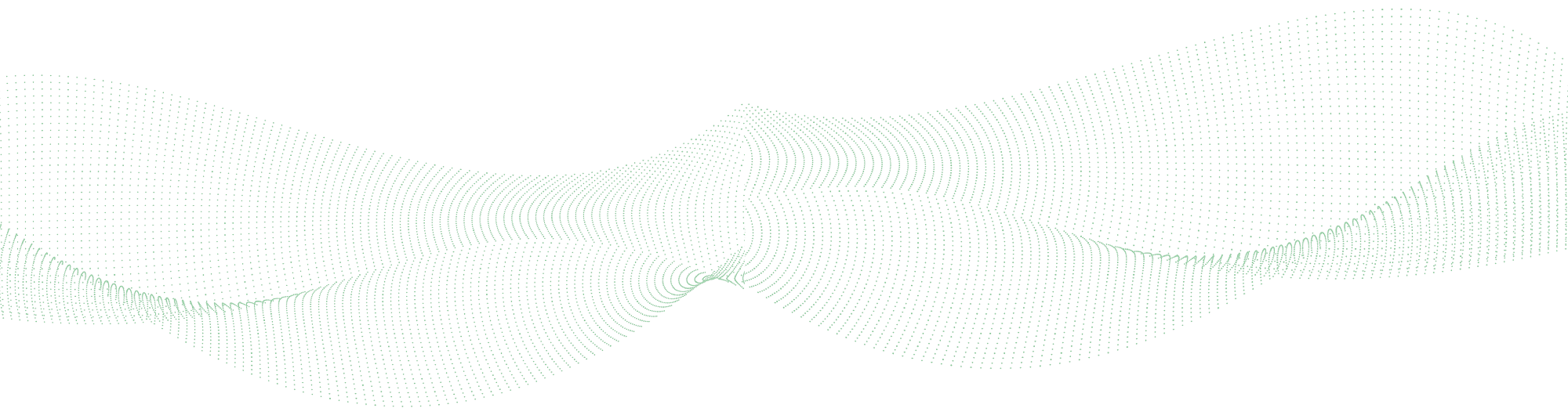

45,240 patent families (91,526 patents) were analyzed for this report. These patent filings were bucketed into various technologies using a structured taxonomy as illustrated below:

Fig. 1.1 Technology Taxonomy for Carbon Management

IAC’s analysis draws on a robust dataset of 91,526 patents, offering a comprehensive view of the global carbon management IP landscape. Since 2005, patent filings in this sector have steadily increased, with a significant surge between 2020 and 2022, reflecting the rising urgency around climate action and industrial decarbonization.

Carbon capture technologies dominate the sector, accounting for approximately 78% of total patent filings, primarily targeting Point Source Capture through Absorption methods. Carbon Utilization technologies are also surging, particularly in converting CO₂ into

Carbon Storage accounts for less than 10% of filings, indicating lower innovation focus.

China has rapidly emerged as the undisputed leader in carbon management innovation:

This dominance is further reinforced by the presence of Sinopec (China Petroleum and Chemical Corporation) – the sector’s top original assignee and the holder of the most active patents globally. China’s innovation engine is fueled by aggressive climate policy, national investment strategies, and a strong emphasis on industrial IP leadership.

Fig. 1.2 Geographic distribution of patent filings in Carbon Management

Besides Sinopec, other global industry giants actively shaping this sector include:

Fig. 1.3 Key Patent Filers – Carbon Management

Their expansive patent portfolios signal deep, long-term commitments to decarbonization technologies.

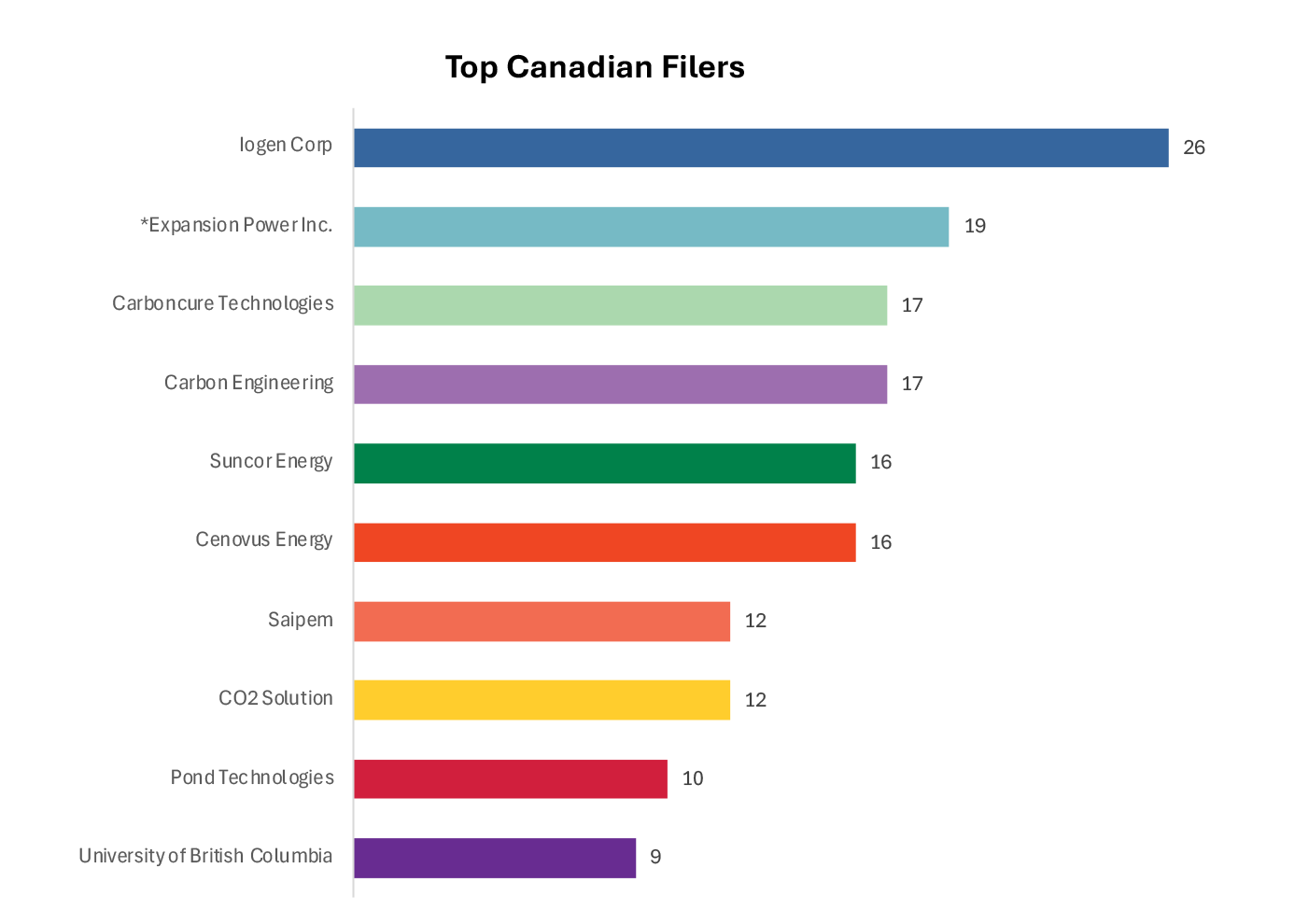

Unlike global trends, Canada’s carbon management patent activity followed a unique path, declining steadily from 2009 to 2018, returning to 2005 filing levels. This downturn may reflect a policy pivot toward short-term economic recovery following the 2008 global financial crisis. Canada has seen 3,387 patent families filed in this sector, while Canadian firms owned just 497 patent families filed globally, reflecting weaker intellectual property (IP) positioning.

Most of the patent filings in Canada, 2,599 patent families, accounted for nearly 76% of the total filings in Canada. These filings were focused on carbon capture technologies, reflecting the global trend in this space.

Canadian companies lag significantly behind global peers in patent ownership. Iogen Corp leads domestically but holds only 26 patent families worldwide. Compared to the key global players, a limited IP presence exposes Canadian companies to critical risks: missed licensing revenues, reduced market access, and vulnerability to infringement or exclusion by competitors with stronger portfolios.

Note: Chart based on patent families; *Patents assigned to 1304338 Alberta Ltd.

Fig. 1.4 Top Canadian filers – Carbon Management

IAC’s landscape report provides a detailed depiction of the value chain associated with the key players involved in various parts of the Carbon management value chain. Understanding the value chain enables companies to identify their current role and uncover opportunities to collaborate, scale, or expand into adjacent segments. Fig 1.5 shows the global and Canadian Carbon Capture value chains with key players.

A detailed value chain for key players globally and in Canada across other key Carbon Management technologies is included in the full report.

Fig. 1.5 Global and Canadian value chains – Carbon Capture

Looking at the patent portfolios of key players like Mitsubishi, Air Liquide, Linde and Exxon Mobil can provide some insights on successful IP strategies as well as risks associated with this space. These are well-positioned global players in the carbon management space with large portfolios and products covered by patent protection. These players are also amongst the top patent filers across various technologies in carbon management as detailed in the previous sections.

Patent Portfolio Development – Strive to build a robust patent portfolio that protects your innovations and deters competitors. Without a significant portfolio of patents, a smaller company involved in an IP dispute with a large company typically lacks the leverage that the ability to counter assert provides. The primary purpose of IAC’s Portfolio is to provide patents that can be counter asserted against companies with large portfolios that could pose a risk to member companies. Read more about IAC’s Patent Portfolio here.

Geographical Considerations – Assess patent rights on a country-by-country basis, as patent laws and enforcement practices vary across jurisdictions. A product or service that may be covered by a patent in one country may not be in another because a similar patent may not exist or be active elsewhere, and the claims may have different scopes.

IP Strategy & Ownership: Prioritize the protection of your intellectual property and put in place strategies to increase its value. These steps are a good start towards increasing your Freedom-To-Operate. IAC’s IP Upskilling program empowers companies to develop and maintain solid, scalable, forward-thinking IP and data strategies.

For a comprehensive overview of these and additional IP strategies, including detailed patent and market data on key players, trends, and jurisdictional considerations, refer to the full report.

Disclaimer: The content of this document may have been derived from information from third-party databases, the accuracy of which cannot be guaranteed. IAC hereby disclaims all warranties, expressed or implied, including warranties of accuracy, completeness, correctness, adequacy, merchantability and/or fitness of this document. Nothing in this document shall constitute technical, financial, professional, or legal advice or any other type of advice, or be relied upon as such. Under no circumstances shall IAC be liable for any direct, indirect, incidental, special, or consequential damages that result from use of or the inability to use this document.

See how our IP expertise can support your business.